LogiClump is a trading technology and fintech software development company specializing in Forex and Cryptocurrency trading terminal solutions. We work with financial businesses that require reliable, high-performance trading systems rather than generic, off-the-shelf platforms.

Our expertise lies in building complete multi-asset trading infrastructure from the ground up— covering execution engines, order management, liquidity connectivity, risk controls, reporting systems, and user interfaces designed for both Forex and Crypto markets. Each solution is engineered with a strong focus on long-term reliability, operational transparency, and performance under high market activity.

A Forex and Crypto trading terminal is the core technology layer that connects traders, liquidity providers, execution engines, and administrative controls into a unified operational environment. It governs how orders are placed, executed, monitored, and managed across multi-asset trading operations.

LogiClump develops custom trading terminals specifically designed for both Forex and Cryptocurrency markets. Each system is customized at every layer—from execution logic and order management to user experience and administrative workflows. Our platforms integrate seamlessly with liquidity providers, internal risk engines, and external services while ensuring complete operational control for your organization.

Every solution is structured to support scalability, transparency, and operational efficiency, helping businesses maintain stable, secure, and future-ready trading environments across global Forex and Crypto markets.

The Admin Panel serves as the central command layer for the Forex and Crypto trading ecosystem. It provides complete oversight, governance, and operational control across all trading activities, users, liquidity flows, and financial operations within the platform.

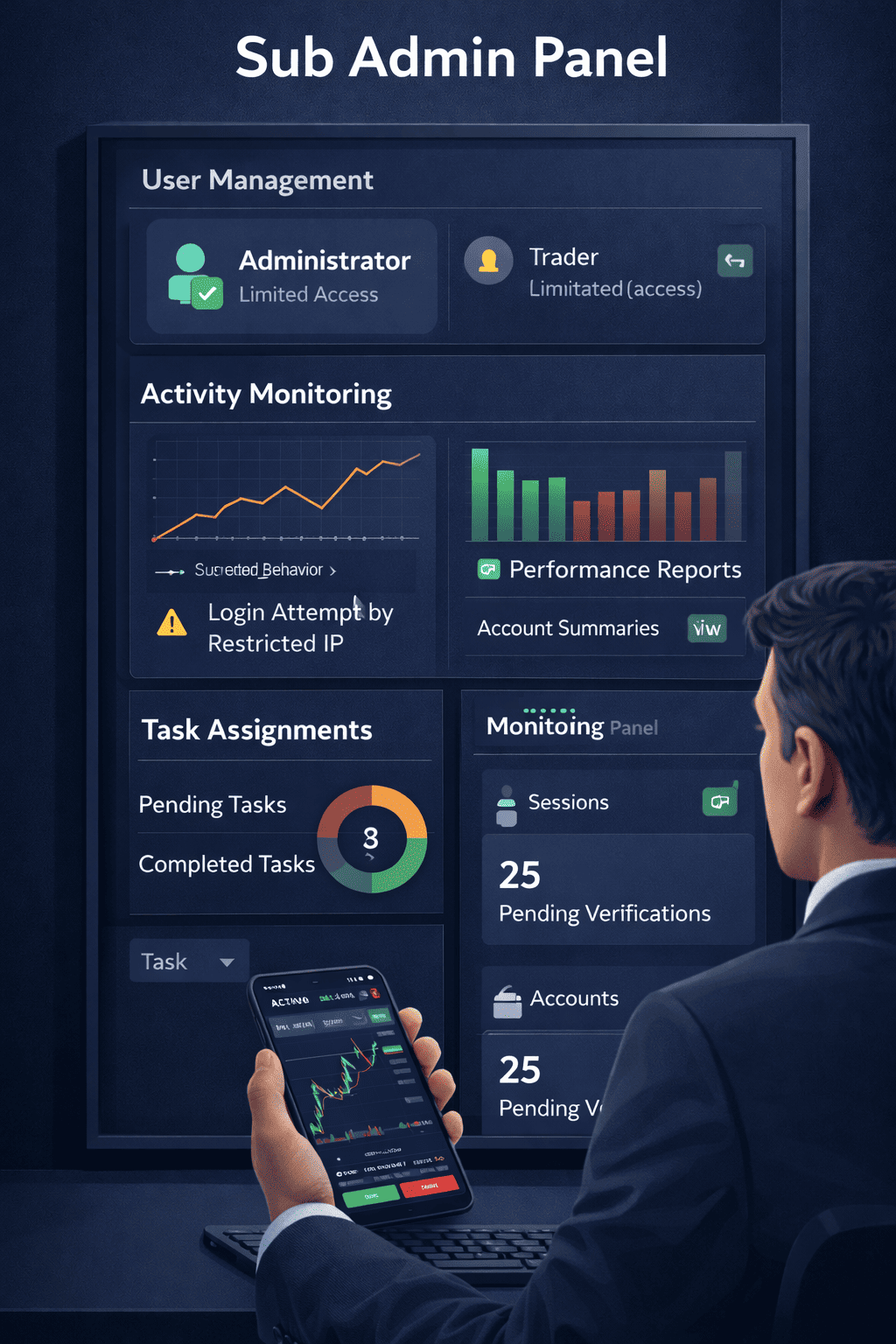

Designed for delegated operations within Forex and Crypto trading environments, the Sub Admin Panel enables controlled access to administrative functions without exposing full system authority. It supports smooth day-to-day operations while preserving security, accountability, and clear separation of responsibilities across multi-asset platforms.

Key Capabilities

Built to support growing Forex and Crypto trading platforms, the Sub Admin Panel ensures efficient task execution, controlled access, and operational oversight—without compromising system security or administrative governance.

The Liquidity Provider (LP) Panel is engineered to manage and monitor liquidity operations across Forex and Cryptocurrency trading environments with precision and transparency. It provides real-time visibility into connected liquidity sources, price feeds, spreads, and execution quality for multi-asset trading platforms.

This panel enables oversight of execution routing, feed stability, and liquidity performance, helping ensure consistent pricing and reliable order execution in both Forex and Crypto markets. As a critical infrastructure layer, the LP Panel supports system integrity, execution accuracy, and dependable market access across global trading sessions.

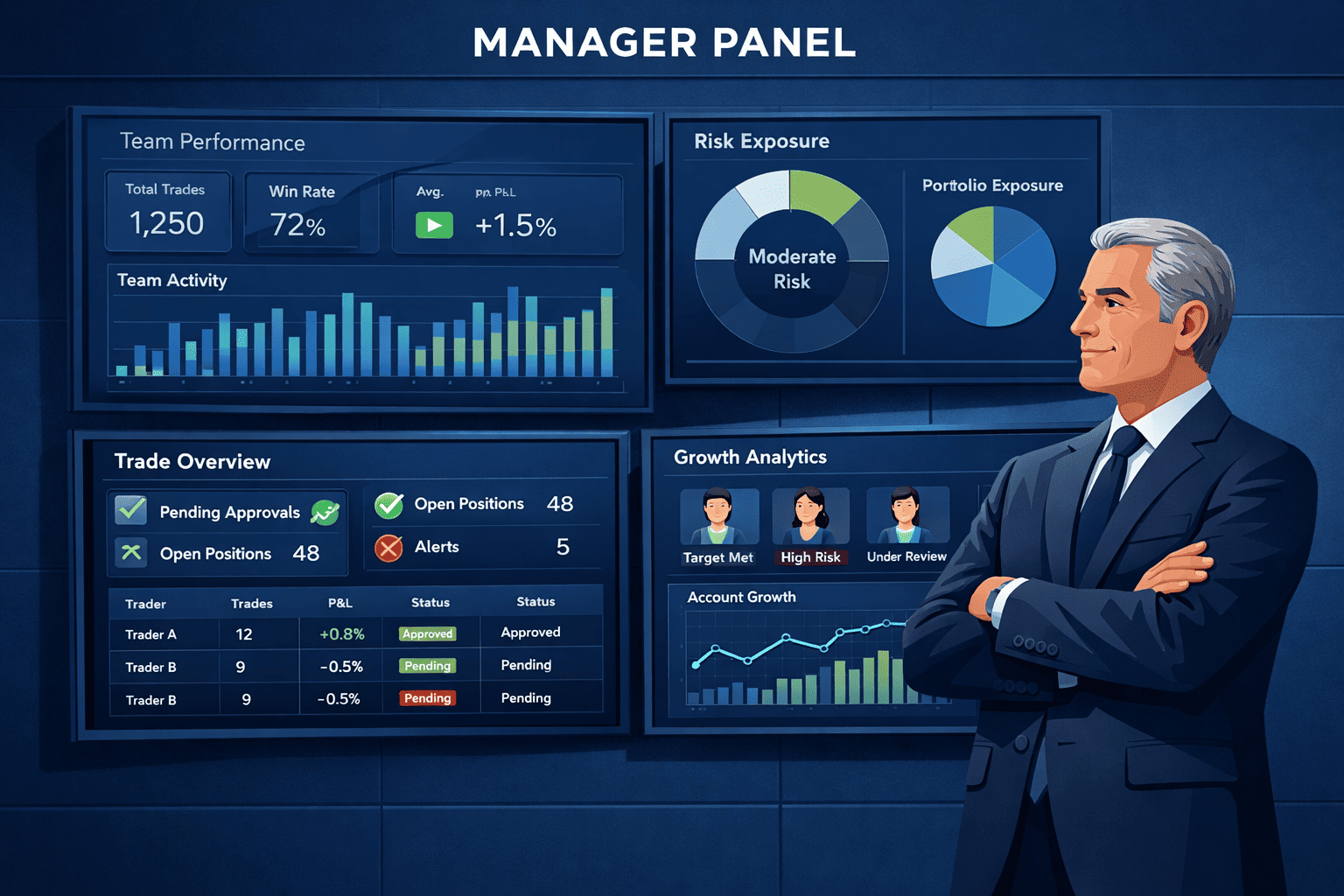

The Manager Panel is designed to provide structured oversight of Forex and Cryptocurrency trading operations across multiple teams and accounts. It offers a consolidated view of trading activity, exposure levels, and performance metrics through well-defined dashboards.

With access to real-time and historical Forex & Crypto data, managers can supervise trade execution, review risk parameters, track market exposure, and evaluate team efficiency. This panel supports informed decision-making, policy enforcement, and disciplined operational control across the entire trading infrastructure.

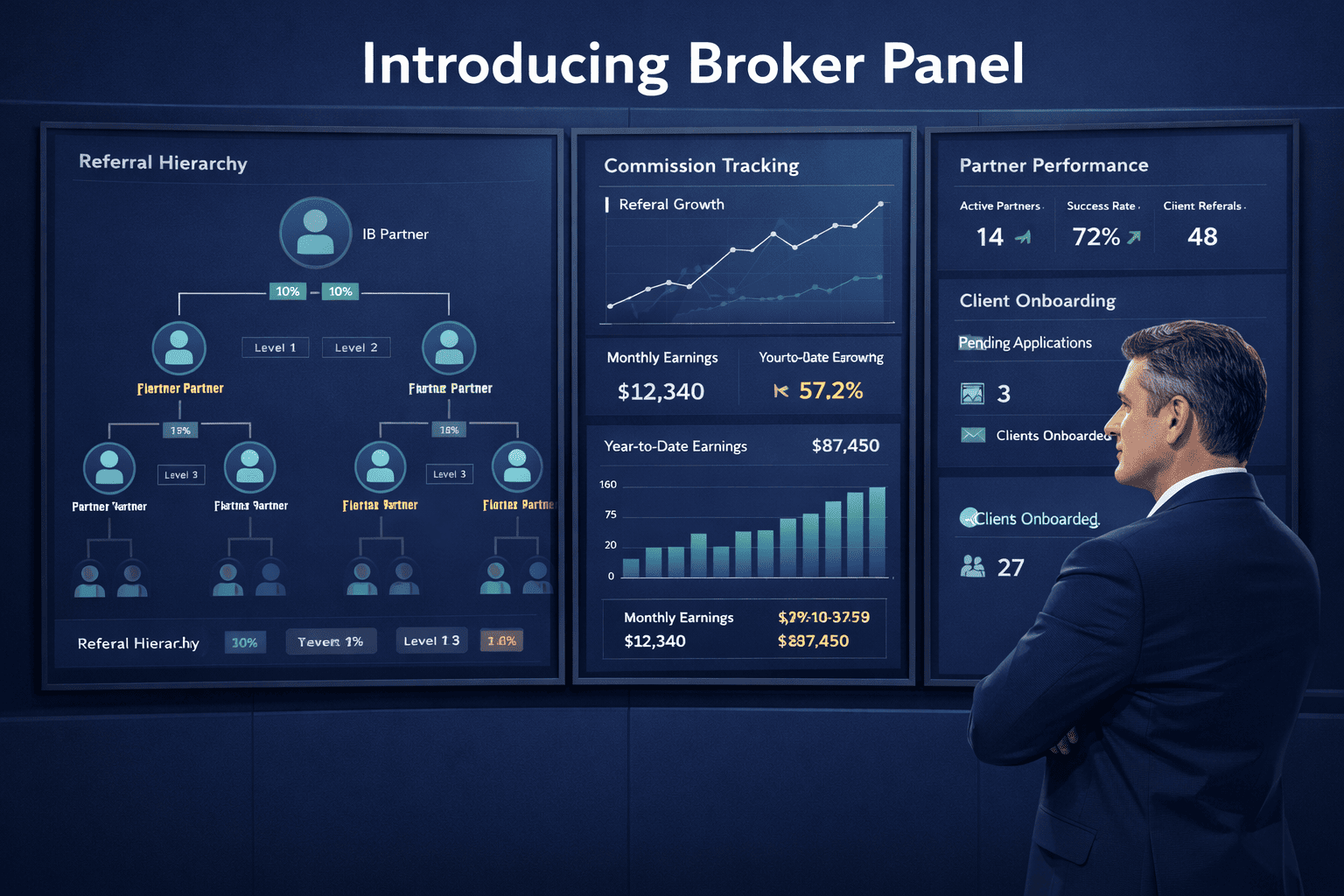

The Introducing Broker (IB) Panel is purpose-built to support structured partnership models within Forex and Cryptocurrency trading environments. It enables systematic management of IB hierarchies, referred trading accounts, and commission structures with complete accuracy and transparency.

IB partners receive clear visibility into trading volumes, client performance, and earned commissions through detailed reports and summaries. At the same time, platform administrators retain full oversight to ensure compliance, correct payouts, and long-term, trust-driven relationships between the trading platform and its introducing partners.

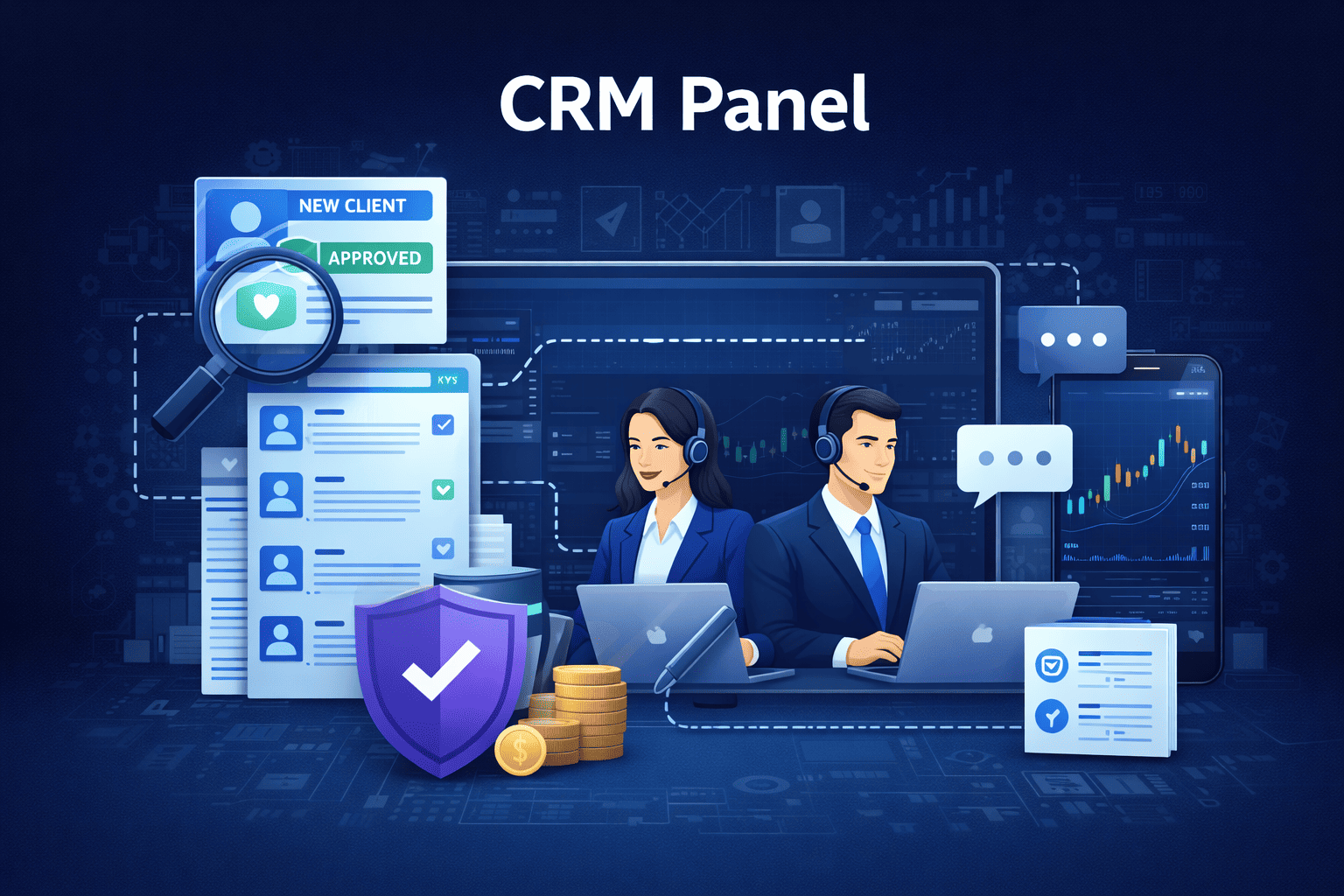

The CRM Panel acts as the backbone of client management within the trading terminal. It handles client onboarding, account setup, and KYC document workflows in a structured and secure manner. The panel also centralizes communication, support tickets, and activity logs, giving teams a complete view of each client’s journey. By organizing customer data and interactions efficiently, the CRM Panel helps improve service quality, operational response times, and long-term client relationship management.

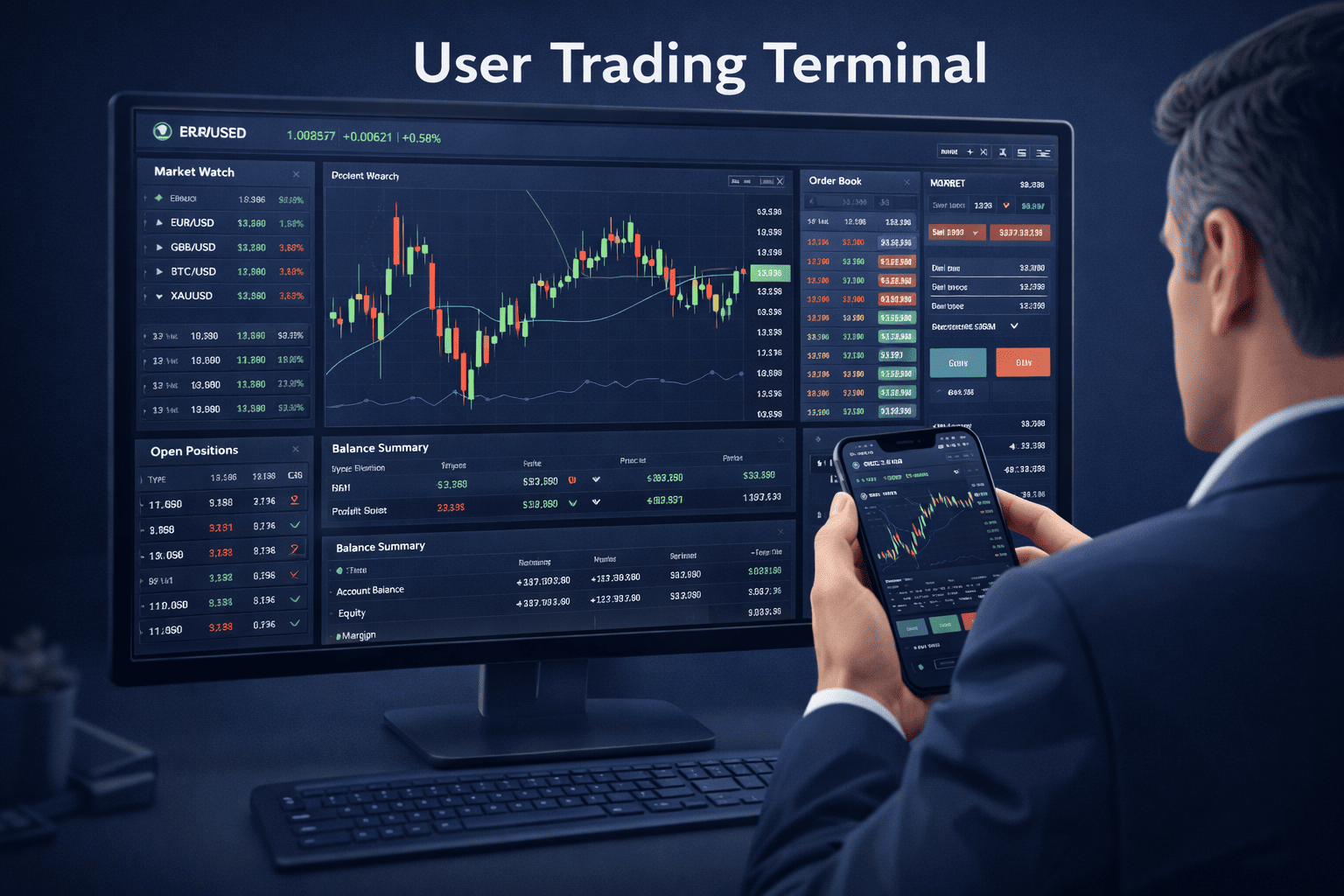

The User Trading Terminal is purpose-built for Forex and Cryptocurrency trading, delivering a stable, secure, and professional trading experience across both web and mobile platforms. It supports high-speed order execution, real-time market feeds, advanced charting, and precise position management for currency pairs and digital assets.

Designed with clarity and reliability at its core, the terminal enables traders to monitor live markets, manage open positions, track balances, and review trade history with confidence. Backed by a robust and scalable architecture, it performs consistently during high market volatility while maintaining strict security and data protection standards.

We build reliable Forex and Crypto trading terminals for businesses that value stability, control, and long-term scalability.

These questions explain how LogiClump designs and delivers Forex and Crypto trading terminals, along with platform roles, access levels, and responsibilities.

LogiClump specializes in the development of custom Forex and Crypto trading terminals. We build complete trading infrastructures, including Admin, Sub Admin, LP, Manager, IB panels, CRM systems, and user trading terminals for web and mobile platforms.

No. LogiClump is a technology and fintech software development company. We do not act as a broker, liquidity provider, or trading firm. Our responsibility is limited to building and delivering the trading systems that clients operate independently.

Yes. Our platforms are designed to support Forex, Crypto, or hybrid trading models. Execution logic, pricing feeds, risk rules, and workflows can be customized based on the market structure and business requirements.

Yes. We develop secure and high-performance trading terminals for web and mobile devices, ensuring consistent execution, real-time data, and account access across all platforms.

Security is built into every layer of the platform. This includes role-based access control, secure APIs, execution validation, audit logs, and strict permission management to protect both Forex and Crypto operations.

Yes. LogiClump trading terminals support API-based integration with Forex liquidity providers, Crypto exchanges, price feeds, payment systems, and third-party reporting or risk management tools.